In 2023, the Life Insurance and Market Research Association (LIMRA) suggested that 70% of Americans were afraid of the financial implications of losing their primary wage earner. About 40% of them are scared about how they will make ends meet if the unexpected were to happen.

Life Insurance is about the money you leave behind to cushion the immediate shock your demise. Most families use it to provide financial support for the burial expenses which is more than $9,000 in Texas in 2023 according to funeral directors.

LIMRA says that the most common reasons preventing people from buying life insurance include:

- Cost - many people think that it is too expensive, yet they overestimate the cost by more than three times the actual cost.

- They have other financial challenges facing the family, yet more than 56% of households with less than $50,000 income need it most.

- About 36% of the people don’t know how much to buy or what type to buy.

Everyone has 40 years active work life

There seems to be some natural acceptance that age 65 is when everything fallas apart. The tapes can't handle the cracks anymore and the crumbling begins. The human body shows it. Apparently, men who made it to 72 in the days that Social Security laws were being put together were champions of God's blessing. However, today, it is not uncommon for 85-year olds to try the marathon, and men are easily scaling the 100-year mark. The insurance industry is responding to the achievements of science, but the Social Security laws remind us that at age 65 letters that we must start getting ready to leave the active work life.

No matter how you do it, the age 65 barometer is a smart one to use for your personal financial security. By barometer, I mean that when you start working you begin to make preparations for age 65. You may work for much longer than this. It becomes gain for you. If the pot collapses before and you get called home before age 65, it is unlikely that you will leave pain behind. Noah tells you that this is cheaper and smarter. Further, as you eye life beyond 65, there are more insurance products to protect your years of labor.

To avoid the kind of pain mirrored in the eyes of this young lady, Noah is able to guide you in money management skills that prepare you for the intersection of undeniable senior treatment and physical retirement, including:

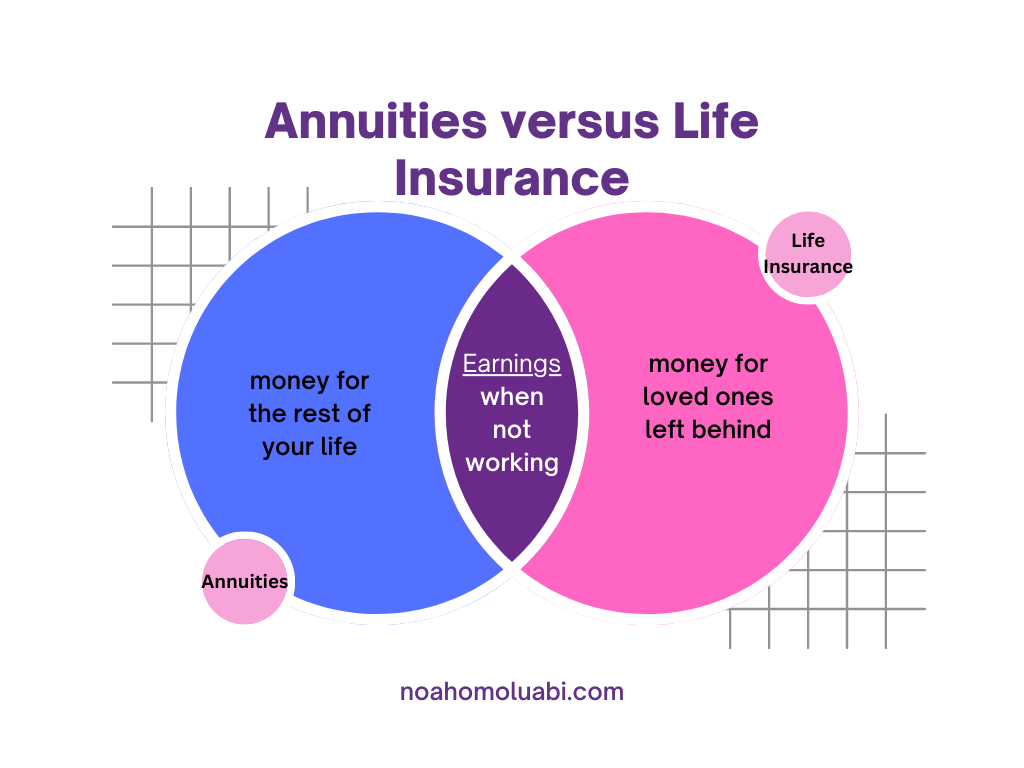

- life insurance to protect you in case of premature death

- annuity products to manage a beautiful lifestyle, even in retirement. That is, if you live long enough beyond that point to make people become jealous and

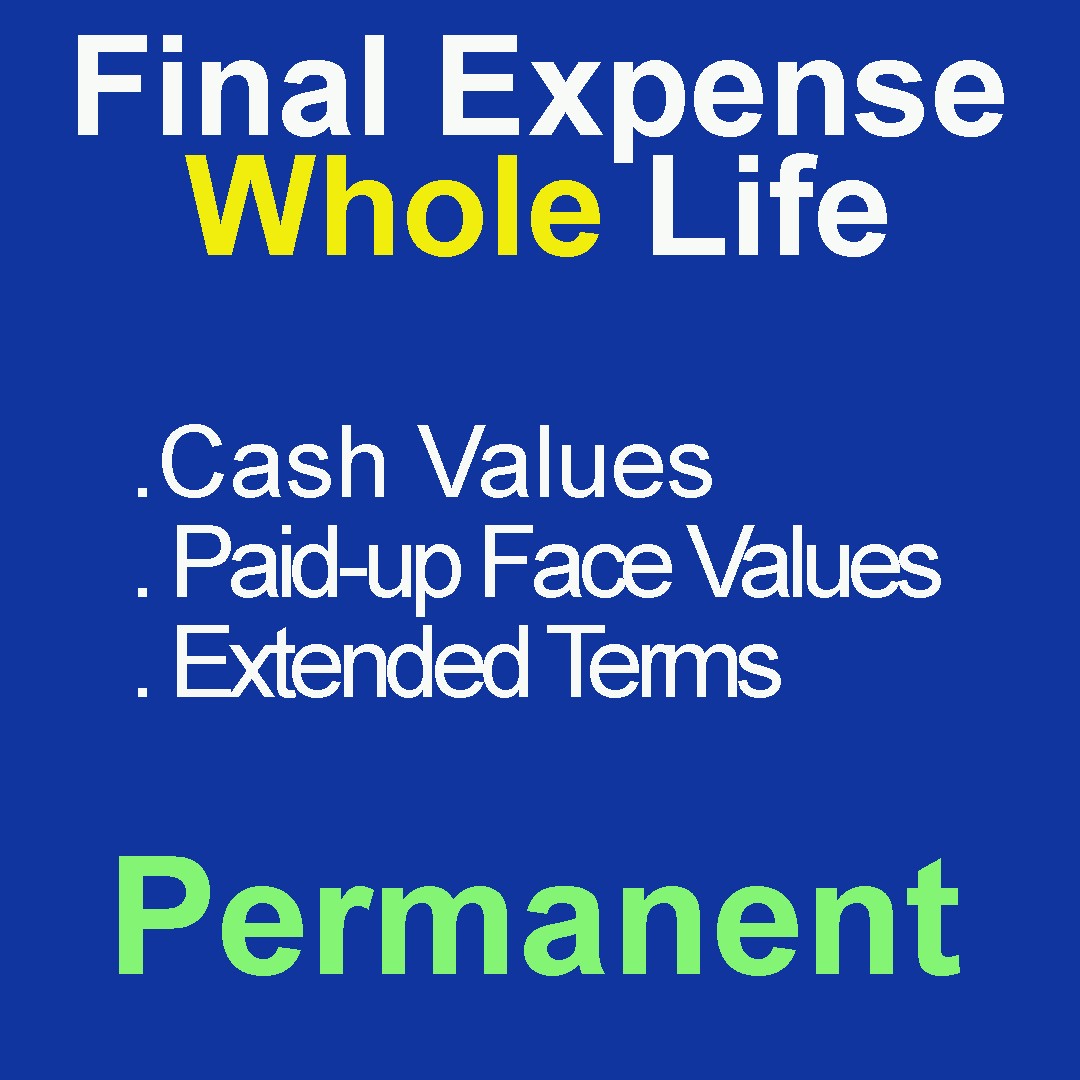

- final expense insurance that makes sure your transition to eternity is properly taken care of.

And when this time comes!

Irrespective of where you may be now in the cycle of life, inflation causes too much uncertainty, thereby decision making as to how much to put aside, for how long and even in what instruments require some professional help to make the simplest guesswork or or to formulate a plan.

Yet, there are mathematical formulas that professionals can apply to your specific situation. Unfortunately, neither you nor the professional can estimate your date of transition to glory. Noah begins with what you can afford and helps you scale up to what you hope should be optimal for your beneficiaries to continue life beyond the grieving period. We also inform you about when it becomes too late to start, if at all. That depends on your aspirations because the insurance market has too many varieties to manage almost every human perception.

There are aggressive wealth building instruments for young people, and there are commercial products designed to wheel the economy through favorable tax treatments, and there are products to make your descedants never lack financially.

It does not matter that you are young and single or your spouse is sick and he/she has not made any written instructions at this time. You may have been pondering the retirement question for some time now, and probably hung up because of poor finanacial preparation. The solution starts with asking someone who may have some knowledge.

Noah helps you make sense of all gamut.

Talk To Noah Now!