Official customer reviews rate our companies between 4.8 and 4.9 on a five-point scale. Compare the shortlist from your research against this rating. Then, you may understand why the choice of your health carrier becomes very important. I bet none rates above 2 stars. We have been in healthcare before Medicare and have been on every table since. To be honest, if Noah does not know, he knows someone who knows.

Therefore, if too much money from contributions like HSA or Roth or distributions like stocks are causing worries. Simply, put are too rich and its worrying or your paycheck is just too heavy to bring close to government. Could it be just the transitioning from employer or spousal insurance to Medicare that is confusing you. Do you really need help catching up with these payments. We have seen many scenarios here, and we understand these things. We can help locate you with what’s appropriate for you. Talk to Noah now.

Maybe, its this business of referral to specialists or being networked not sounding well with your post-retirement freedom considering your grandchildren and important family functions. Noah knows about that too.

We answer your questions to fill gaps in your knowledge, but you are under no obligation to obtain a quote or enroll through us. Our reviews confirm that we are in the business of helping. Ask Noah for an appointment to chat now.

Medicare Supplement Insurance policies are designed to reduce the out-of-pocket medical care costs that Medicare does not pay. This is why they have the -gap in their acronym Medigap. Our mantra is that every decision we make is based on what is best for the customer. We have found that it is the age-long secret to sucess, stability and strength that produces measurable quality and and excellent service. |

Pillars of Our Medigap plansFreedom of ChoiceThis is the non-notiable strength of the Medical Supplement plans. You are not trapped with any physician. No refferal or approval is needed to knock on the door of a specialist and get service. Any doctor or hospital that accepts Medicare cannot refuse you treatment anywhere and anytime in the United States. Some plans even extend that freedom overseas. Guaranty of ServiceIf you are a fresh Medicare applicant, you are essentially guaranteed |

acceptance and coverage almost instanly with no medical history and similar questions asked. Acceptance under other sitatuion requires evaluation on a case-by-case basis and time of year. Financial StrengthExperts have rated our company AA- for over 45 years straight. Consumers rate us between 4.8 and 4.9 out of 5. |

Guaranteed Issue means that you cannot be denied coverage for medical reasons or any similar discriminating circumstances related to your age, health status or where you live. When you miss you initial open enrollment period for Medicare Supplement, then the insurer may require that you undergo underwriting to qualify because you are out of the Guaranteed Issue window.

The initial open enrollment period for Medicare Supplements falls on the first day of your birth month that you turn 65 years old and runs for the next 6 months. As long as you are enrolled in Medicare Part B, you are entitled to enroll in Medigap during this period without underwriting.

Other circumstances that qualifies one for Medicare equally qualifies one for Medigap such as a qualifying disability for people who have been receiving Social Security Disability Insurance for at least 24 months; and certain illnesses, such as end stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS).

In addition, clients losing their group coverage which normally pays after Medicare pays. In other words, people who have been working or whose have been on their spouses employee health care plan that have been enrolled in Medicare as well.

The initial open enrollment period for Medicare Supplements falls on the first day of your birth month that you turn 65 years old and runs for the next 6 months. As long as you are enrolled in Medicare Part B, you are entitled to enroll in Medigap during this period without underwriting.

A Medicare Advantage (MA) client that receives a notice that their MA plan is terminating is entitled to a guaranteed issue. If an MA client moves to an area not serviced by their current MA plan, they are also entitled to guaranteed issue. Also, MA clients who have not spent 12 months on their first MA plan since initial enrolment are entitled to guaranteed medigap policy.

Ask Noah Now!

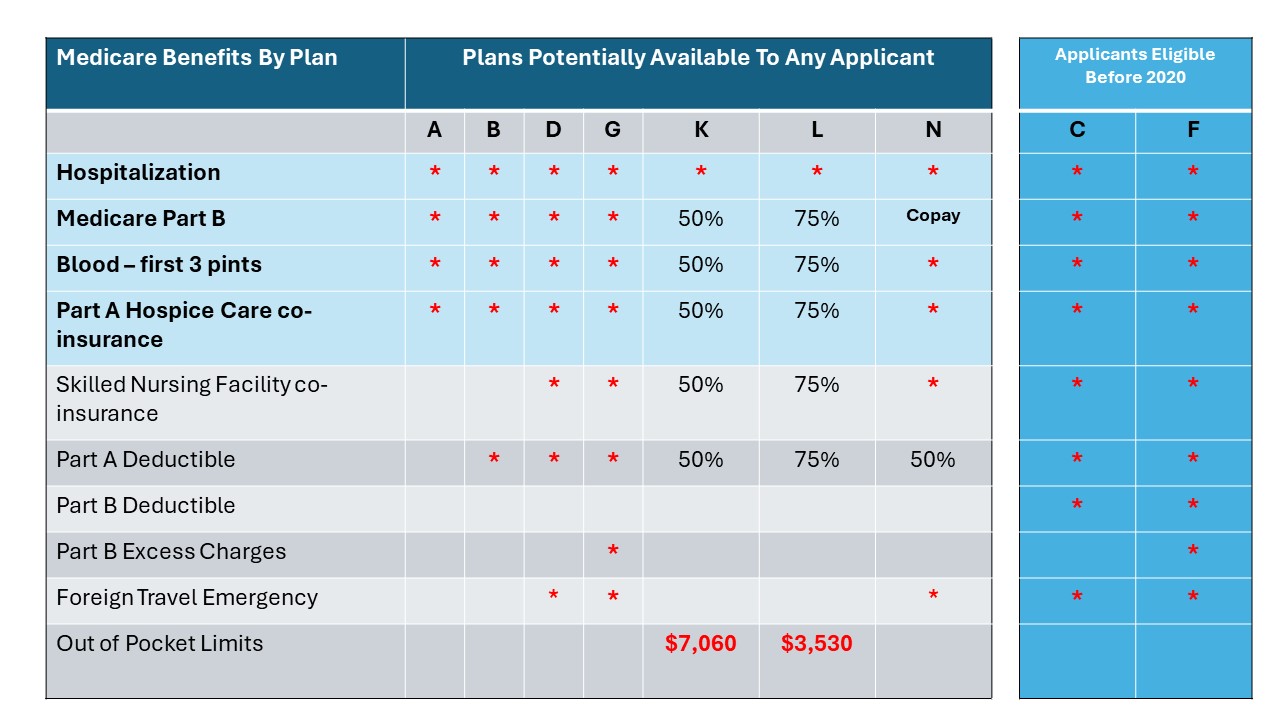

These are standardized available plan types as defined by law. Any company offering any of these plans offer similar benefits packaged into the plan as defined by the authorities. Each plan varies by thier offerings for Medicare deductibles, co-insurance, and expenses not coverd by Medicare. Company-wise, The only difference across carriers is cost of premium paid to insurers, also called carriers.

There are 12 standardized plans under the Medicare Supplement Program. However, each carrier may not offer every plan in every state.

The table below outlines the 11 of the 12 plans that we currently carry.

- Part A co-insurance plus hospital coverage for 365 addtional days after Medicare benefits end.

- Part B co-insurance (generally, this is about 20% of Medicare approved expenses) or co-payments for hospital out-patient services. Plans K, L and N require insureds to pay a portion of the Part B co-insurance or co-payment.

- First 3 pints of blood per year.

- Part A co-insurance for eligible hospice/respite care expenses.

The asterisk sign (*) means that 100% of the benefits are paid by the plan.

Plans F and G have a high deductible option which requires that that you first pay a plan deductible of $2,800 before the plan begins to pay. After meeting this deductible, the plan pays 100% for covered services for the rest of the calendar year. High deductible plan (HDG) does not cover Plan B deductible. However,payments for your Part B deductible under High Deductible Plan F (HDF) and HDG count towards your the plan's deductible. An additional $240 (Part B deductible) may be payable by the insured.

Plans K and L pay 100% for covered services for the rest of the year once you meet the Out-of-Pocket limit. The Out-of-Pocket annual limit not include charges from the provider that exceed Medicare-approved amounts termed Excess charges. The insured will be responsible for paying those charges. The Out-of-Pocket limit is adjusted each year to account for inflation in the economy.

Plan N pays 100% of the Part B co-insurance, except for a co-payment of up to $20 for some office visits and up to $50 co-payment for emergency room visits that do not result in an in-patient admission. The emergency room co-payment is waived if the insured is admitted to any hospital, and the emergency room visit is covered as a Medicare Part A Expense.

Medicare expenses in retirement may cause financial challenges. On average, according to the 2024 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $165,000 in after-tax savings to cover health care expenses. Medicare doesn't pay for everything. For example, medicare does not pay for long-term care, most dental care, eye exams, dentures, cosmetic surgery and acupuncture to mention a few.

Our company pay records for 2022 shows that customers ages 65-67 had an average of $753 in medical claims, 68-72 year olds claimed about $906 on average and people 73-years and older claimed $1,127 on average.

Which brings up the question concerning high deductible versus high premiums. Why pay more in premiums to avoid a deductible that you may never meet? The key to the answer lies in how many times you need to see a doctor. If you are in good health, then a coverage that saves you hundreds in premiums surely sounds better.

Our HDG plan offers the same benefits as Plan G with an annual deductible of $2,800 in 2024 my area. Plan G premium is $138 while Plan HDG premium is $37 bringing annual savings to $1,212 for a 65-year old woman, non-smoker in 2023. Therefore, if one is in relatively good health, the considerable amount of savings makes the HDG more attractive.

Talk To Noah Now!